City looks to Utilities to help Solve Budget Crisis

Recommendation to borrow utility funds to support city services

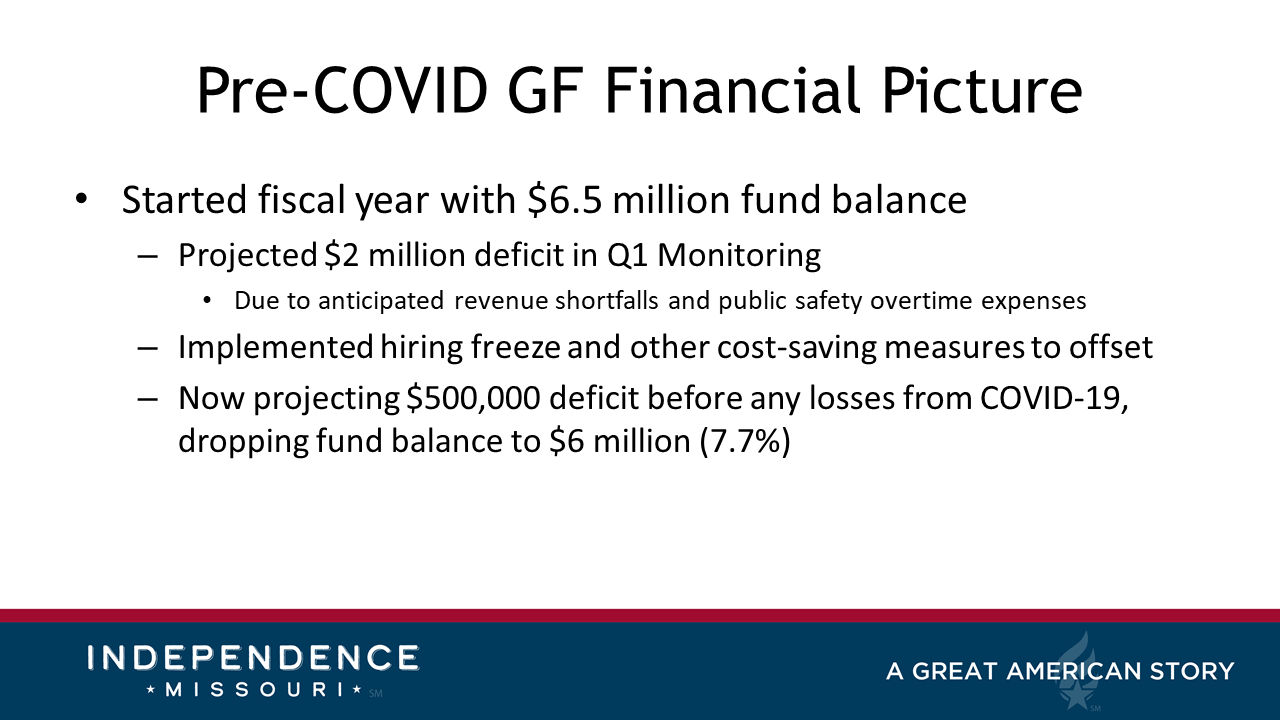

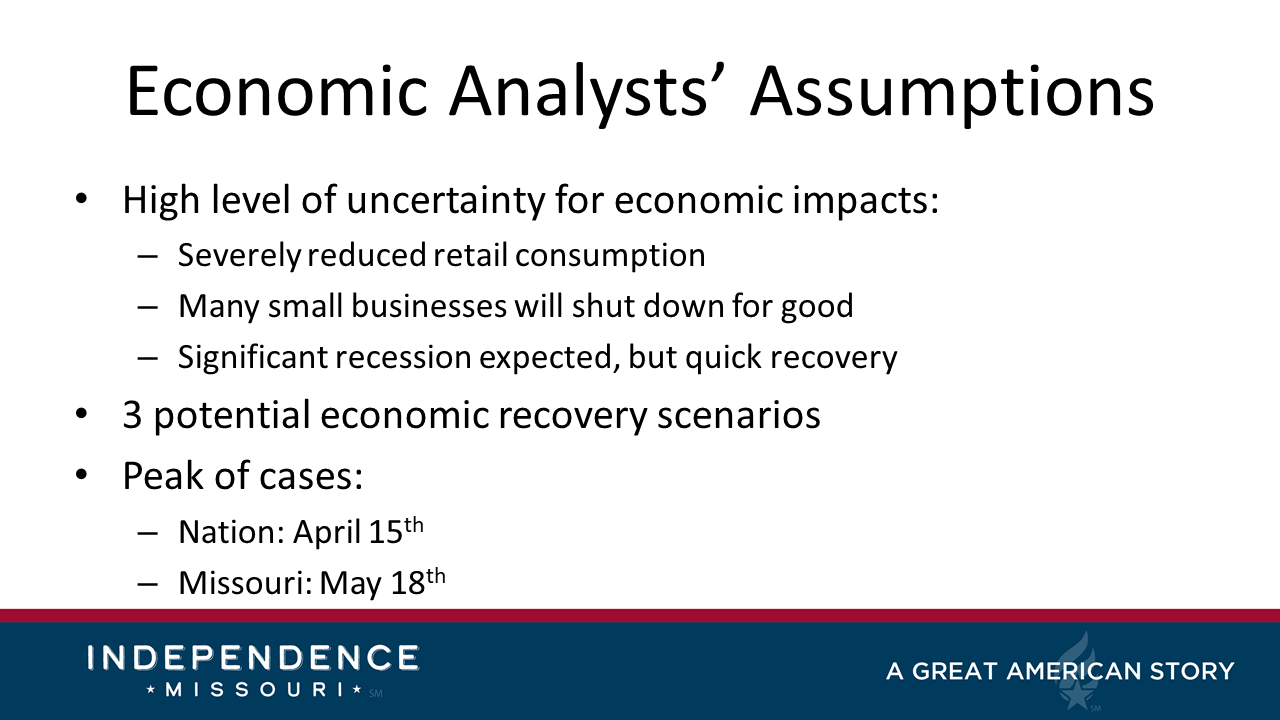

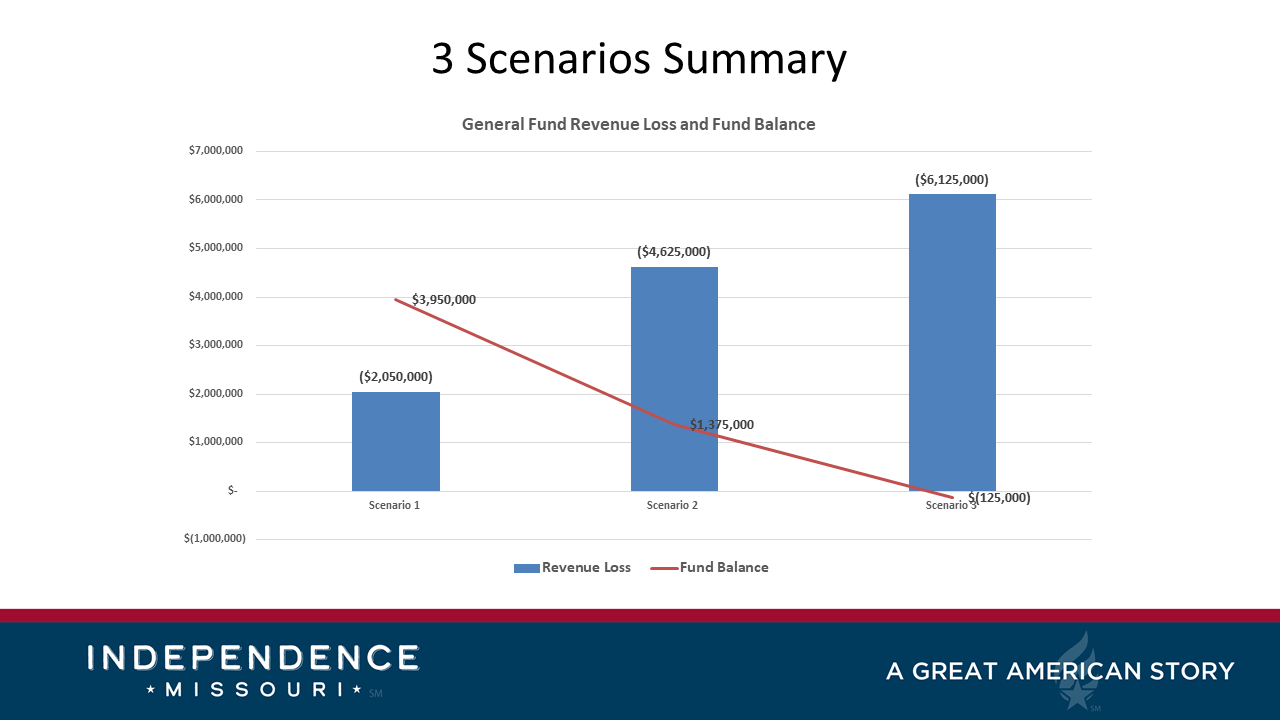

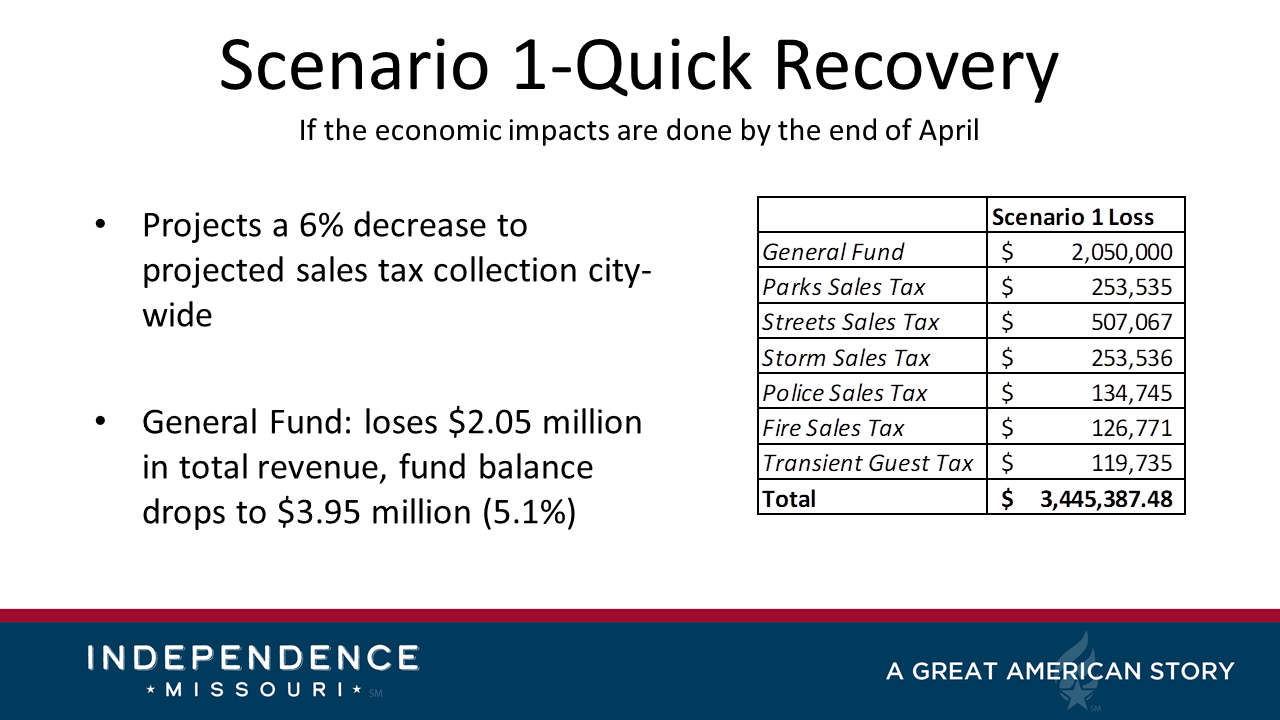

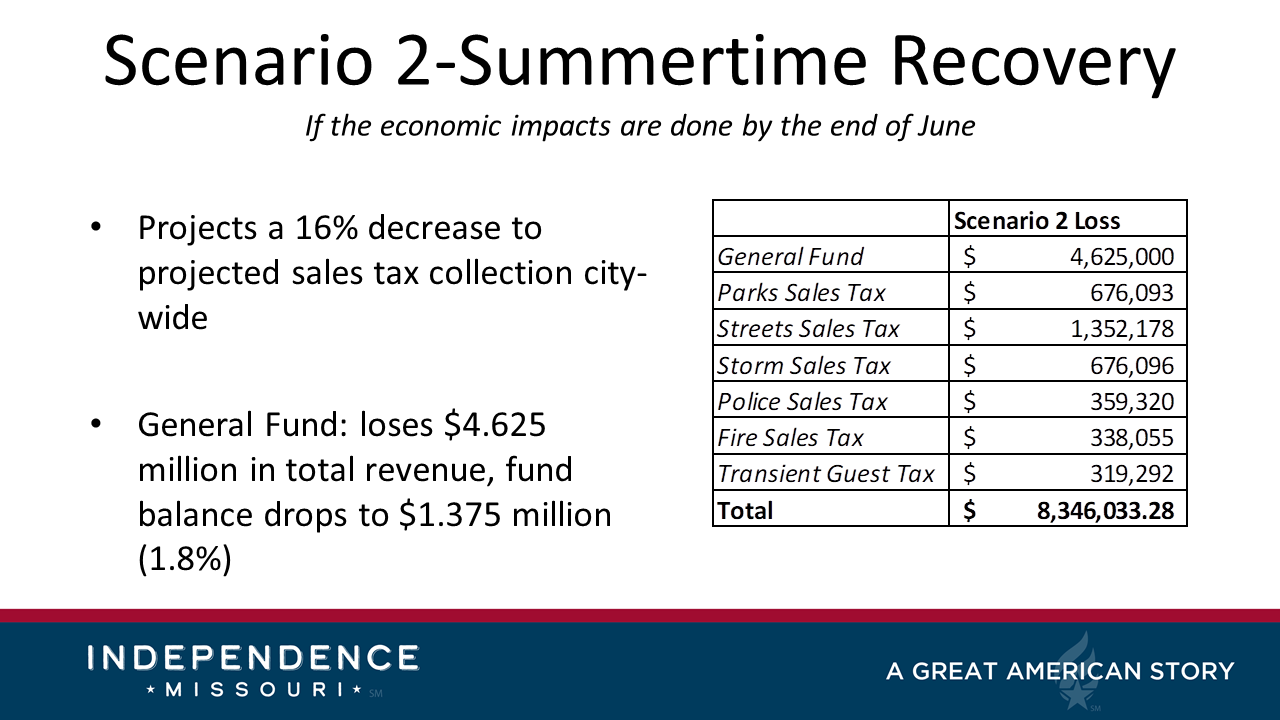

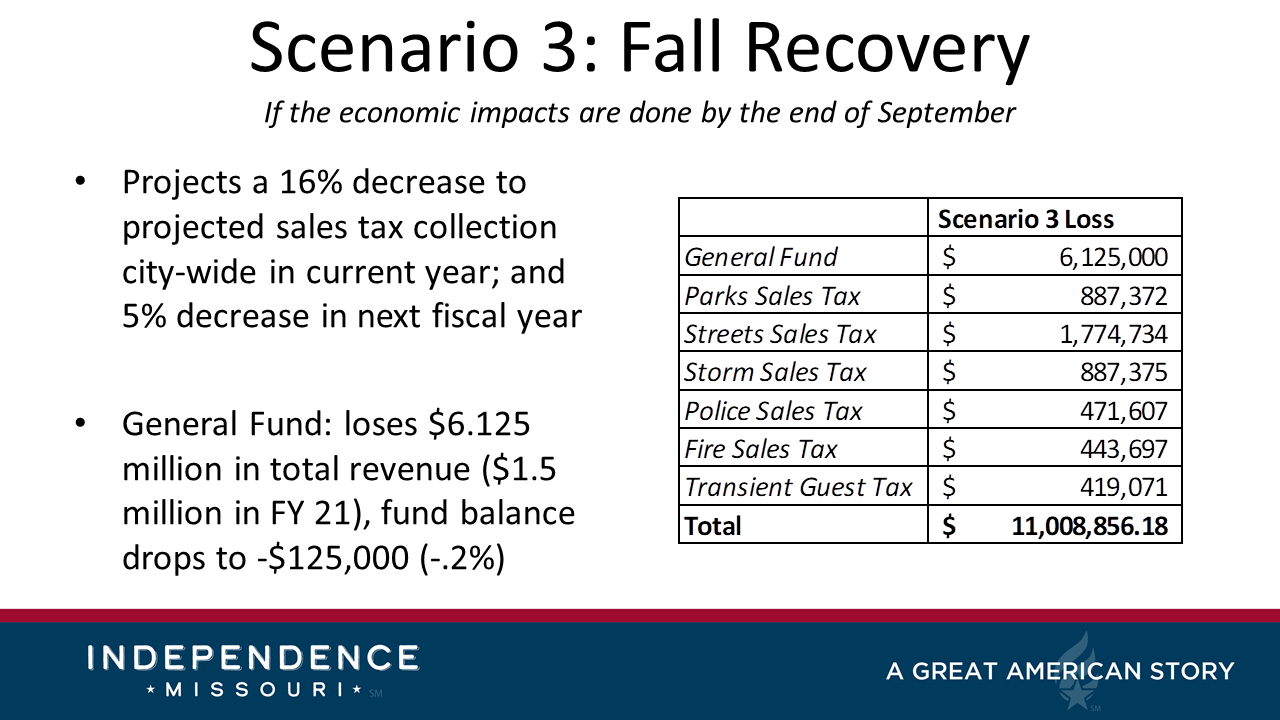

The coronavirus will have a profound impact of the City of Independence's finances with a fiscal hit to the city's general fund between $3.4 up to $11 million depending on when recovery starts, according to city staff.

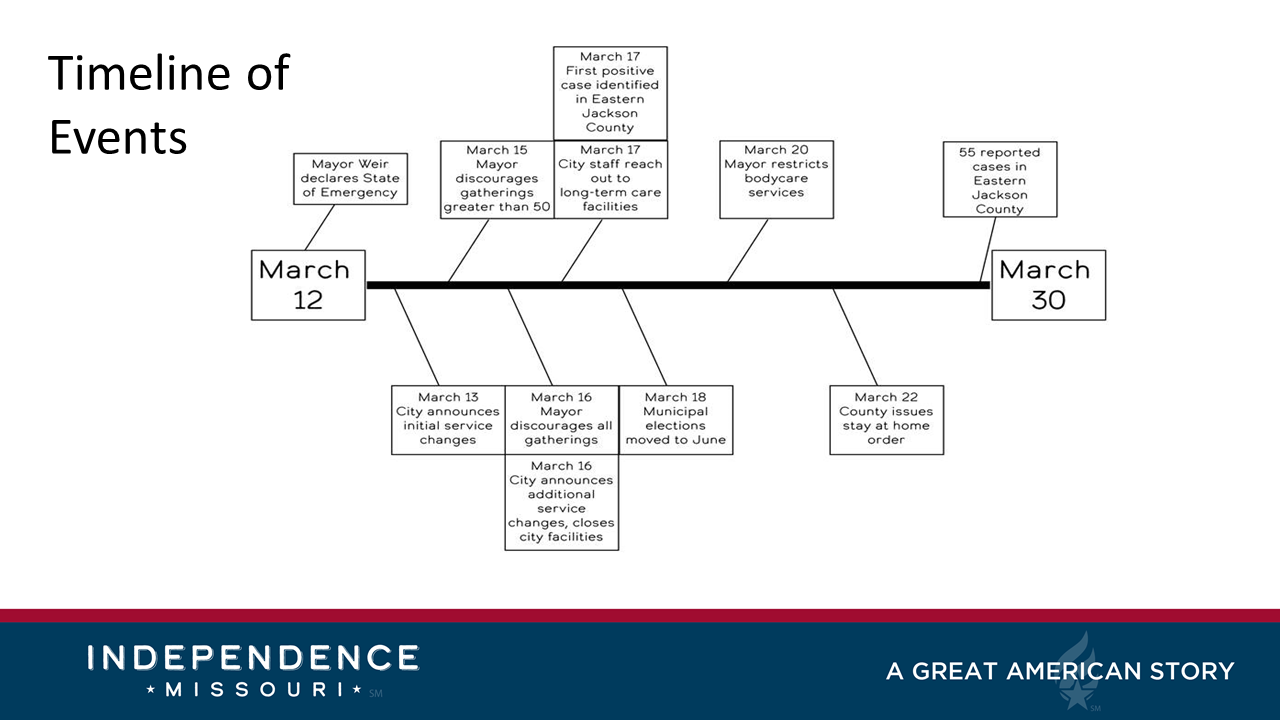

The grim outlook was presented to the City Council Audit and Finance Committee Wednesday during an online meeting.

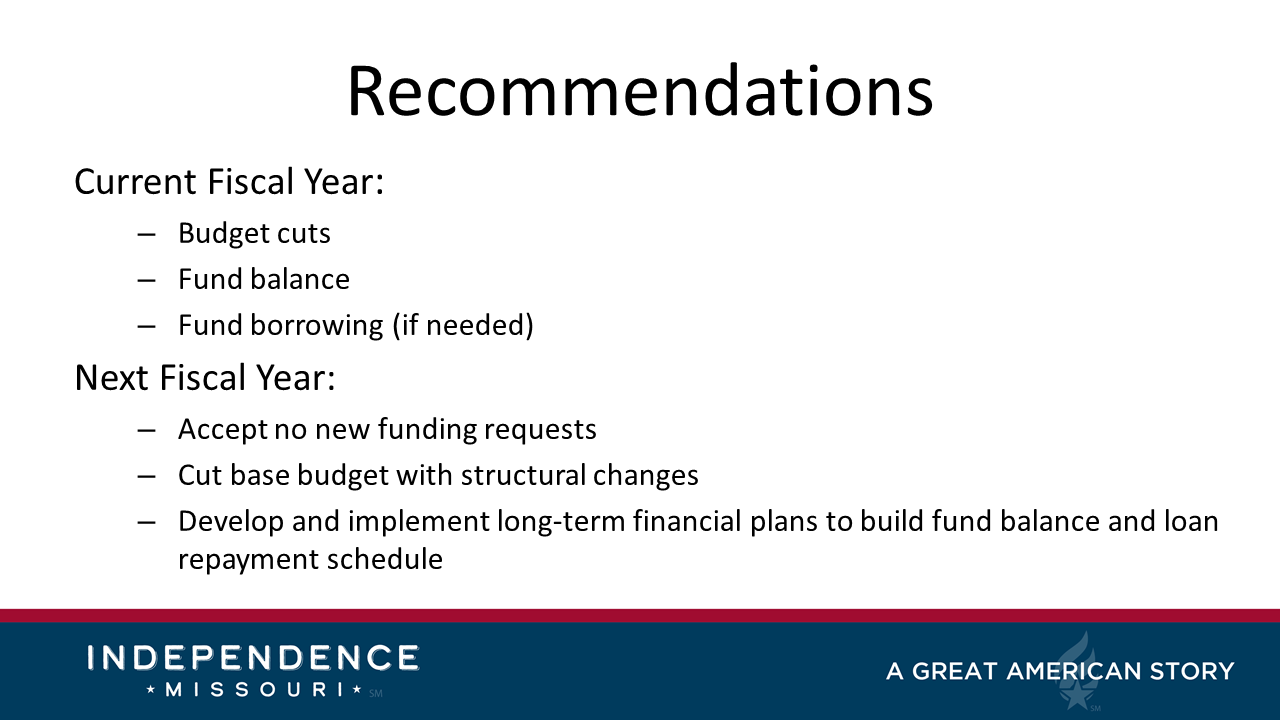

To avoid fiscal disaster, City Manager Zach Walker recommended several actions including budget cuts, no new funding request and borrowing from the city's utility fund balances (if necessary) to provide much needed cash to sustain city core operations.

The Audit and Finance Committee unanimously approved a recommendation to establish a $25 million Covid19 separate designated fund to provide the city cash liquidity. Committee members are Council member Karen DeLuccie (chair), John Perkins and Scott Roberson.

The recommendation will be considered Monday by the City Council.

Walker requested establishment of Covid19 fund to give the city staff the ability to tap the fund and only with approval of monthly requests approved by the City Council. The potential size of the new fund discussed by the committee was $25 million - drawn from the city-owned electric and water utilities.

The city would pay interest on any funds borrowed at an interest rate higher than what they currently earn. Any funds borrowed funds would be repaid to the respective city-owned utilities based on an agreed upon repayment schedule. This is essentially a line of credit the city would draw upon.

City staff are working on more details to present at Monday's council meeting

This easily is the most consequential decision any City Council has faced in recent history.

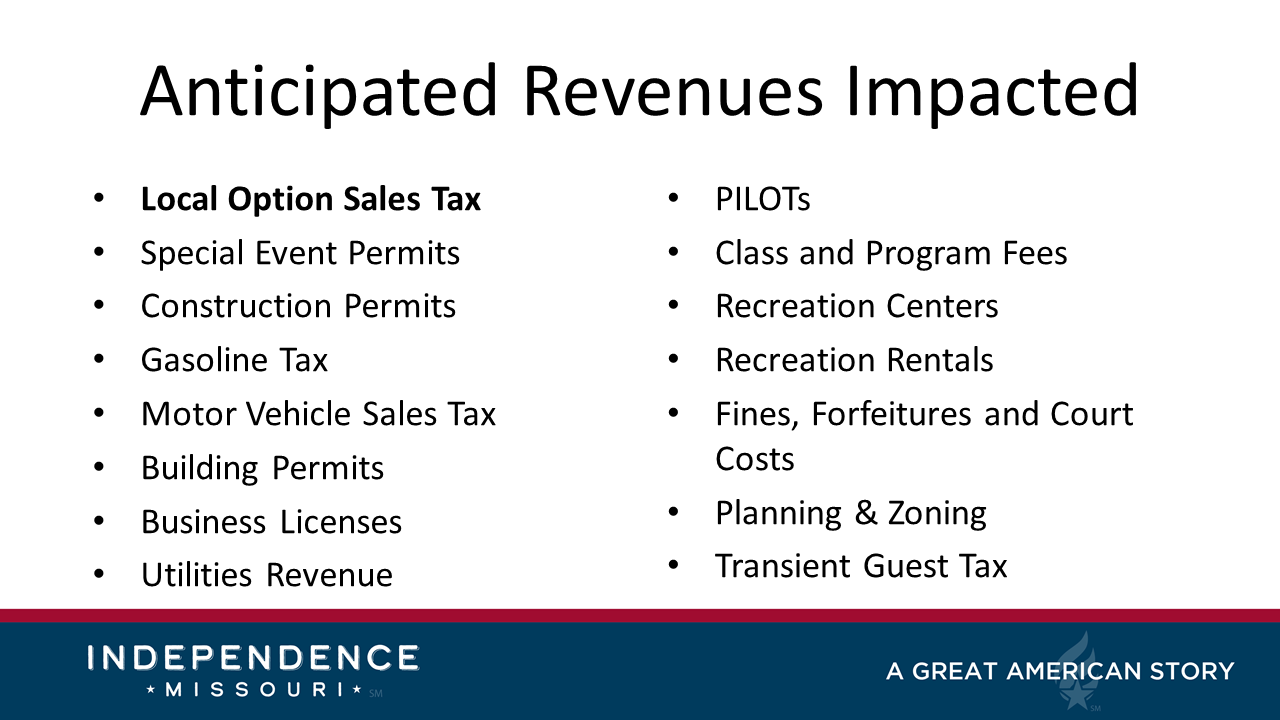

Failure to establish the designated fund would force significant cuts in city staff and services and potentially affect the city's bond rating. Ongoing current city expenses quickly would outstrip incoming revenue, particularly sales tax revenue.

This is an unexpected jolt to an already tight budget that was already being developed. Other local governments are also dealing with the impact of the coronavirus and struggling with how to respond to the unexpected fiscal calamity.

The Covid19 fund is a similar approach to how the city funded the Uptown Market in 2018. In that instance, the city borrowed $2.5 million from the water department. The 15-year loan carries a 2.5% interest rate and paid off in 2033.

City staff (then and now) point to Section 8.8 in the city charter as providing the authority to borrow from the city's enterprise utility funds.

Economic Outlook

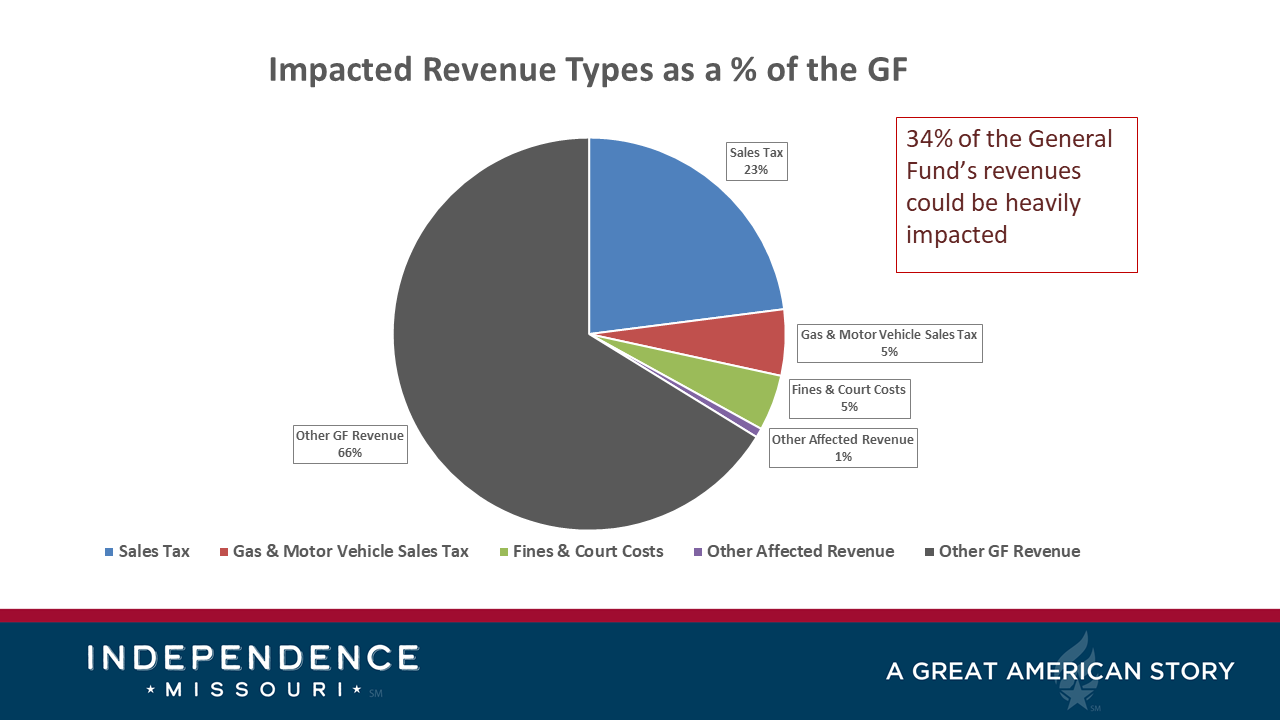

The worst scenario - recovery starting in September - illustrates the fiscal challenge facing the city. Independence, more so than other communities, relies heavily on retail sales taxes to fund local government.

Retail sales are expected to decline sharply. Citizens are asked to stay at home, many residents have been laid off or had hours curtailed, stores and restaurants are closed including major retail outlets like Independence City - a major sales tax generator.

This scenario projects a 21% decline in projected sales tax collection for the year - 16% in the current fiscal year which ends June 30th and 5% in the next fiscal year. This scenario shows the city fully depleting its $6.5 million fund balance.

The discussion at the Audit and Finance Committee was to initially draw on the fund balance until it reached 5%. At that point, the city would borrow from the designated utility funds with requests made monthly for additional amounts.

Utility Bill Forgiveness

Another idea kicking around is a month forgiveness on IPL bills. This would further complicate the city's financial position.

The seven-member volunteer Public Utilities Advisory Board is online Friday in a special meeting to consider a one month forgiveness of utility bill forgiveness. Recommendations by the PUAB are advisory.

During the Audit and Finance Committee, there was discussion of increasing the city's contribution to the utility assistance programs administered by the Community Service League to provide targeted utility assistance.

The average month collections on all city utilities is approximately $16 million per month.

Forgiving a month of city utility bills would mean a loss of approximately $1.4 million to the already hard-pressed general operating fund because all utility customers pay a 9.08% franchise fee which goes to the city.

The city has already agreed not to shutoff utilities during the public health crisis and forgo late fee charges for nonpayment

IPL wants to maintain its own reserve fund of approximately $26 million. The fund balance as of June 30, 2019 was $22.8 million.

Electric utilities generally try to maintain significant cash balances between 90 to 120 days of normal operating expenses. It is a capital intensive businesses and can be financially affected by severe weather. For example, the City Council will consider a $2.5 million contract to repair substation H. (See below)

The city-owned utilities - IPL and water - have reserved other funds to potentially pay for Advanced Metering Infrastructure (AMI). That project was put on hold by the City Council last year in response to a citizen petition opposing the project.

IPL has over $250 million in outstanding bond as of June 30, 2019. There are four separate outstanding bone issues with maturity dates between 2035 and 2046. The bonds for several IPL projects including purchase of an interest in the Dogwood natural gas power plant in Pleasant Hill.

Summary

The underlying public health situation is fluid and changes daily, but the current fiscal impact is already apparent on city finances.

The longer this continues will own deepen the impact with some predicting unemployment rates of 20% or more and real prospect of a significant recession affecting individual households, businesses and the economy.

Some federal aid may be available, but so far little is directly targeted at smaller-sized local governments. Federal disaster relief may become available but it takes years to be reimbursed.

City Council decisions made (or not made) will have consequently impact on the city's near and longer-term fiscal fortunes.